Domestic chips have shifted from substitution to accelerating internalization or going global

Whether the future world will form a (chip) technology system led by China and the United States may sound reasonable, but from the perspective of industrial development, if such a situation really happens, it is probably a huge sadness and may be a result of multiple losses

On March 27th, Wei Shaojun, Chairman of the Integrated Circuit Design Branch of the China Semiconductor Industry Association and a professor at Tsinghua University, stated at the SEMICON China 2025 Semiconductor Exhibition Global Semiconductor Industry Strategy Summit SEMI Industry Innovation Investment Forum (SIIP China) that the current situation of China's chip industry is "strange" and the international situation is "unpredictable". Although the chip industry is influenced by geopolitics, 'no country, no company can do everything', and the world needs everyone to cooperate.

Wei Shaojun emphasized that China's chip and semiconductor industry still needs to have firm confidence and maintain development determination.

In fact, due to the impact of the 2023 industrial downturn cycle, the global chip industry is gradually recovering.

According to WSTS data, driven by demand for AI, HBM (high bandwidth memory), and other technologies, global chip revenue reached $626.8 billion in 2024, a year-on-year increase of 19%. Among them, the sales revenue of China's chip industry was RMB 1.43 trillion, a year-on-year increase of 16.7%; The production reached 451.4 billion yuan, a year-on-year increase of 22.2%.

However, Zhang Li, Vice Chairman and Secretary General of the China Semiconductor Industry Association, believes that from an investment perspective, market demand other than AI is still weak and lacks effective growth, resulting in a slight decline in capital expenditures of major global semiconductor companies in 2024. Looking ahead to 2025, WSTS predicts that the global semiconductor market is expected to maintain a growth rate of 11.2%, reaching $697.2 billion.

Nowadays, China's chip industry is both a low-end direction of "domestic substitution" and an accelerating "vicious competition" that damages market interests. Thousands of chip industry chain companies are competing for the same business. As Li Haiming, Senior Vice President of Xinlian Microelectronics, said: Are we "replacing domestic production" or "replacing domestic production".

Global Chip Industry Market Statistics from 2009 to 2025

Domestication is accelerating, but the demand for mature process chip supply chains has gradually become saturated

Recently, there have been reports that China will no longer purchase Nvidia H20 AI chip products when building new data centers or expanding existing facilities in the future, mainly because their performance is lower than their high-end GPUs and does not meet relevant requirements.

At the same time, several leading Internet manufacturers such as Tencent and Alibaba added H20 server orders. In addition, Baidu, Tencent and Ant also increased the purchase of domestic GPU (graphics processor) computing cards. Even Ant's technical team used chip products such as Alibaba and Shengteng to reduce the cost of AI model training by 20%.

The market demand for high computing power AI chips represented by GPUs reflects the sales status of the entire semiconductor industry: while domestic enterprises mainly purchase foreign chips, they also purchase some domestic chips as "backup" options.

So this has accelerated the "domestic substitution" of chips to a certain extent, making the market share of domestic and international giants almost equal.

A report released by Texas Instruments (TI), a US analog chip giant, in March this year showed that in China, analog chip companies face fierce competition, with 15% of chip sales coming from local (domestic substitute) suppliers, 15% from TI, and 70% from overseas and Japanese suppliers. Currently, 20% of TI's revenue comes from the Chinese market (with some used for exports).

In fact, chips are crucial for the global economy. It is also a core component in many fields such as smartphones, computers, artificial intelligence, the Internet of Things, and automotive electronics, directly affecting the development level and innovation capability of these industries, and thus having a profound impact on the technological competitiveness, economic development, and national security of the entire country.

However, the uncertainty of geopolitics has prompted countries to promote the "deglobalization" and regionalization of the chip industry chain, resulting in companies transferring their supply chains and forming a "decoupling and disconnection" of the industry chain, which is also a reshaping of the globalization model. However, the global nature of the semiconductor industry determines that the supply chain cannot be completely 'fragmented'. For example, the eight year long construction of chip export controls on China by US Presidents Trump and Biden ultimately led to the development of semiconductor companies such as Zhongwei, Northern Huachuang, and Xinkailai.

Former US Secretary of Commerce Gina Raimondo has stated that the US should focus more on investing in domestic innovation rather than imposing bans and sanctions. Attempting to prevent China from developing semiconductors is foolish.

Raymondo pointed out, "The only way to defeat China is to stay ahead. We must run faster and surpass innovation, that's the way to win. Despite various export controls imposed by the United States on several Chinese companies, many Chinese companies are still able to purchase chips. In addition, China's innovation seems to continue, and despite the obstacles posed by US sanctions, many companies and organizations are forced to unleash their creativity in pursuing their goals

However, with the passage of time and market demand saturation, domestic chips have now shifted from "substitution" to accelerating "internalization" or going global.

According to data statistics, in 2024, the sales revenue of China's chip industry reached 1.43 trillion yuan, of which the import of integrated circuits was 385.65 billion US dollars, a year-on-year increase of 10.4%, and the export of integrated circuits was 159.5 billion US dollars, a year-on-year increase of 17.4%. The export growth was more than 7 percentage points higher than the import growth. In January and February 2025, China's integrated circuit exports saw significant growth, with a year-on-year increase of 11.9%.

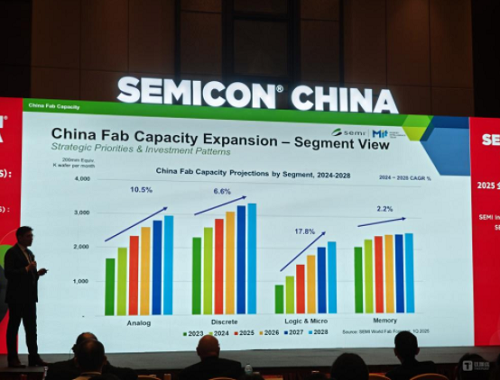

According to SEMI statistics, China's investment in analog and logic chip manufacturing will increase in the future, but the overall growth is lower than expected, and only less than 30% of the world's new wafer factory capacity is in Chinese Mainland. From the perspective of capital expenditure, China still has an investment increment of over 20 billion yuan in semiconductor equipment and manufacturing.

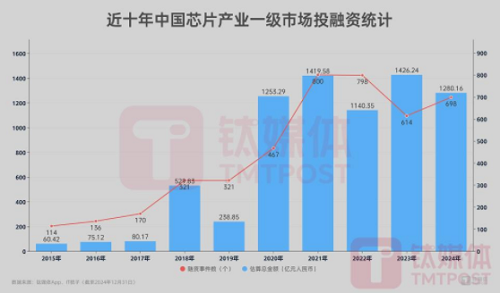

In terms of the primary market, according to IT Orange statistics, in 2024, the financing transaction volume of China's chip and semiconductor industry was 658, with a total financing amount of about 122.016 billion yuan, a year-on-year decrease of about 14.45%, a decrease of about 20.6 billion yuan.

This means that investment and financing by Chinese chip companies have begun to slow down, with over 20 billion yuan of funds disappearing from it.

On the other hand, from the perspective of AI cloud investment, the global semiconductor industry still has incremental space. According to statistics, data centers will account for 17% of the chip and OIT market in 2023, up from 23% last year. Looking ahead to 2028, the entire data center market is expected to exceed a trillion US dollars in size. At the same time, AI accelerators and memory demand will drive continued growth in the data center industry this year. It is expected that computing demand from the cloud to the edge will grow at a rate of 10 times per year, with DRAM revenue expected to increase by about 30%.

I think we have seen a large number of devices become smarter and generate more data. But now, when we start thinking about the next direction of AI development, we are in the early stages. That's why I believe data centers are such a big innovation because many innovations are driven by necessity, and I believe that necessity does drive innovation to a large extent. We believe that data center infrastructure will continue to receive investment at least in the next few years, and because of this, we are seeing a very long growth cycle in the infrastructure field, especially as AI migrates more to the software field, "said Mario Morales, President of IDC's Global Semiconductor and Empowering Technology Research Group.

Therefore, at present, apart from AI, the global chip industry may no longer have significant incremental investment space, and the period of chip manufacturing expansion caused by the shortage of "chips" in the previous two years has ended.

From the perspective of the domestic market, the localization rate of some products in the fields of chip manufacturing, equipment, and design is indeed constantly increasing. However, most companies are developing mature processes and mid to low end products, while some semiconductor equipment manufacturers are starting to shift from selling second-hand equipment to finding people to research and develop low-end replica equipment and service solutions. While they are indeed improving themselves, it has accelerated the industry's "vicious internal competition". In addition, in terms of investment, top equipment companies such as Northern Huachuang and Zhongwei Semiconductor have already established a level of competitiveness with international giants. However, middle and rear equipment and material enterprises can only do "small businesses" and may have little room for investment returns, making them no longer the "best investment targets" for investors.

A chip industry insider told Titanium Media's silicon-based world that currently in China, except for certain companies, everyone is doing 80% business, while foreign giants such as Intel and AMD are doing 90% to 100% innovation. In China, they are all competing for people, replicating, and offering low prices, and cannot achieve the so-called "curve overtaking". More importantly, they are following the trend.

Li Haiming stated that three years ago, there was still 30% -40% growth potential in the production of 55nm, 40nm to 28nm. Domestic demand far exceeded supply, but after two or three years of expansion, domestic equipment and semiconductor products for 55nm and 40nm have now reached saturation.

The SEMI report predicts that global investment in semiconductor equipment will reach $121.5 billion by 2025 and further increase to $139.4 billion by 2026. From now until 2027, it is expected that 105 new wafer fabs will be put into operation, including 75 in Asia. By then, the scale of wafer fab equipment (WFE) will grow to over 122 billion yuan.

Among them, SEMI pointed out that by 2025, China's investment in computing chip manufacturing equipment will reach 38 billion US dollars. It is expected that by 2026, AI will drive an additional 18% increase in chip manufacturing investment, thereby driving the global semiconductor industry to grow to $1 trillion by 2030 and over $2.1 trillion by 2035.

AI and tariffs remain development variables, with over 50% of the global chip market expected to come from China by 2030

On March 25th local time, the Bureau of Industry and Security (BIS) under the US Department of Commerce published two documents in the Federal Register, adding 54 Chinese technology companies and institutional entities to the so-called "entity list", including AI, chip, quantum computing and other industrial chain enterprises such as Beijing Zhiyuan and Inspur Information. It is expected to take effect on March 28th.

This is the first time in less than 100 days of Trump's second term administration that Chinese companies have been included in the list.

Prior to this, the US Department of Commerce had already restricted supply to thousands of Chinese chip companies. According to public information, as of October 31, 2024, there were a total of 3870 entities on the export control restricted list maintained by the US Department of Commerce's BIS, of which 1012 were from China, accounting for 26.1%.

Meanwhile, it is expected that on April 2nd, the US government will begin imposing "equivalent tariffs" globally and impose additional tariffs on specific industries, including chips, computers, sports equipment, automobiles, and agricultural products.

According to analysis by American research institutions, if the "equivalent tariff" measures take effect, it means that the average tariff in the United States may increase by 10 to 15 percentage points. Trump stated that he is using this approach to reclaim wealth that he believes previous administrations unreasonably gave up, in order to address trade and fiscal deficits. Regarding the imposition of tariffs, Trump has also clearly expressed a greater intention.

Handel Jones, CEO of International Business Strategy (IBS), said that Trump's increase in tariffs has caused a decrease in consumer confidence in the United States, and he is "sorry for the price hike". Therefore, Germany may face an economic recession, and according to the German Chamber of Commerce, China's imports from Germany will decrease by 35%.

Obviously, AI and tariffs will be two important "variables" for the development of the global chip industry this year.

During SEMICON 2025, Ye Tianchun, Secretary General of the China Integrated Circuit Innovation Alliance, stated that he has noticed that the United States, Europe, and Japan are attempting to rebuild their manufacturing systems. China needs to focus on the Chinese market and use its industrial system as the cornerstone to rebuild a regional market.

This industry has three characteristics: technology intensive, capital intensive, and talent intensive, so it requires the integration of industrial chain, innovation chain, and financial chain. "Ye Tianchun said that enterprises still need to firmly believe that globalization has its prerequisites, and in the face of new situations, we need a new globalization system. In addition, as the world is evolving from informatization and digitization to intelligence, this may be an opportunity for the chip industry.

Ye Tianchun emphasized, "In the current turbulent environment, we certainly need to build a ship to protect ourselves. We need to find ways to break through through innovation and cause foolish floods for these political household servants. We need to find a way to open a Three Gorges ship and a railway, and the world will return to peace. We need the support of people all over the world

Ye Tianchun emphasized, "In the current turbulent environment, we certainly need to build a ship to protect ourselves. To find a way to break through the foolish floods caused by political politicians through innovation, we need to find a way to open a Three Gorges ship and a railway. The world will return to peace, and we need the support of people all over the world

One of the biggest highlights of this year's SEMICON is SiCarrier, a company that has only been established for over three years, showcasing 31 new domestically produced equipment with a crowded booth.

According to Du Lijun, President of the Process Equipment Product Line at Xinkailai Industrial Machinery Co., Ltd, AI、 The increasing demand for computing power in industries such as intelligent driving is driving steady growth in the semiconductor equipment market. The evolution direction of new equipment technologies is towards higher energy control accuracy, faster hardware response speed, and larger process windows. Taking radio frequency/plasma fields as an example, it is expected that there will be a 10 fold improvement in energy control accuracy and a hardware response speed improvement from 10 milliseconds to 1 millisecond in the evolution process from 7 nanometers to 3 nanometers.

In fact, including chip companies such as Xinkailai and Zhongwei, like DeepSeek, China is achieving the localization of advanced processes through new technological means.

Handel Jones stated that Chinese chip companies have made progress in many areas, with very optimistic progress in NAND and DRAM. The breadth of commercial products such as MCUs and analog products has increased, and China's key needs are new processor architectures and support for accelerating chip applications.

Jones predicts that by 2030, 50% -60% of the global chip market sales will be in China. From the consumer side, China is currently the world's largest semiconductor market.

Technological blockade will drive stronger innovation momentum. Jones said that Chinese companies need to develop competitive products without the most advanced technology and replace traditional practices with new architectures.

On March 28th, Lin Ben chien, Dean of the Institute of Semiconductor Research and former Vice President of Research and Development at TSMC, stated that in the past, the semiconductor industry was developed based on a free economy foundation, and countries had to show their strengths and make up for their weaknesses in equipment, materials, and design in order to make rapid progress. The United States' measures such as tariffs and export bans will reverse the semiconductor industry and affect the global economy.

Lin Ben chien emphasized that countries around the world want to achieve semiconductor self-sufficiency, but if China is forced to innovate materials and structures, achieve advanced semiconductor processes under the blockade of the United States, and take advantage of low prices and large market advantages, companies such as TSMC may face challenges.

Yuan Yipei, Vice President of Xinxin Financial Leasing Co., Ltd., believes that it has been very difficult to promote domestic development in the past period of time, and there may not have been any services provided. Therefore, in the geopolitical environment related to chips, the Chinese industrial chain system has taken advantage of the situation and its momentum is constantly accelerating, thus giving rise to many business models. Nowadays, China is steadily on a development track, while the United States may find years later that they made a significant strategic mistake, as it actually facilitated the maturity and better development of China's chip industry.

Wei Shaojun believes that the Chinese chip and semiconductor industry still needs to have firm confidence, maintain development determination, concentrate on development, and focus on development. Semiconductors are an industry that is made by doing, not by words, and its value should be proven through practical actions.

"In fact, the past decade has taught us a lot of lessons. We have been deeply influenced by the development of the Internet, and 'pigs can fly at the tuyere'. So, can such a view really change the semiconductor industry? Look at the enterprises that have been swiping the screen (such as Xinkailai) in the past two days, which are the results of our continuous persistence and hard work in this field. The development of semiconductor in China and even the world has proved this. So if we want to become stronger, we should focus on and act instead of focusing on what to say, and more importantly, what the enterprise has done." Wei Shaojun said.

Wei Shaojun emphasized that the semiconductor industry needs to be down-to-earth, persist in the long term, and be brave in innovation to form differentiated competitive advantages. Only by constantly striving, doing the right things, and doing things correctly can we achieve ultimate victory.